Youtube top 10 most viewed songs most popular youtube names top 10 on youtube cool youtube names youtube names the names of god youtube youtube names youtube names ideas youtube names ideas for boys

YouTube names the top 10 most-viewed videos uploaded in 2021

YouTube has dropped its list of top trending videos and creators of the year.

MrBeast, the YouTuber who made headlines recently for his re-creation of Netflix's survival drama Squid Game, came No. 1 in the US for the video I Spent 50 Hours Buried Alive. It's notched up over 147 million views since it was released in March.

In second spot came video Minecraft Speedrunner VS 5 Hunters, which currently has 62 million views.

MrBeast was also the US' top creator, sitting at 75.7 million subscribers when the list data was collected. But since that Squid Game video's release in November, MrBeast's subscriber count has jumped up to 82.3 million.

As for top music video of 2021, the honor goes to Pooh Shiesty for Back In Blood (feat. Lil Durk), released in January. At time of writing, it has just under 211.5 million views.

Scroll down for the full lists of most-viewed YouTube videos of 2021.

US Trending Videos

- MrBeast: I Spent 50 Hours Buried Alive

- Dream: Minecraft Speedrunner VS 5 Hunters

- Mark Rober: Glitterbomb Trap Catches Phone Scammer (who gets arrested)

- NFL: The Weeknd's FULL Pepsi Super Bowl LV Halftime Show

- CoryxKenshin: Friday Night Funkin' KEEPS GETTING BETTER AND BETTER (Part 2)

- Dhar Mann: Kids MAKE FUN OF Boy With AUTISM, They Instantly Regret It

- America's Got Talent: Golden Buzzer: Nightbirde's Original Song Makes Simon Cowell Emotional

- Biden Inaugural Committee: The Inauguration of Joe Biden and Kamala Harris | Jan. 20th, 2021

- Forge Labs: I Spent 100 Days in a Zombie Apocalypse in Minecraft... Here's What Happened

- Dude Perfect: Game Night Stereotypes

US Top Creators

- MrBeast (75.7M subscribers)

- Dhar Mann (13.6M subscribers)

- SSSniperWolf (30.2M subscribers)

- CoryxKenshin (11.7M subscribers)

- Dream (27.2M subscribers)

- TommyInnit (11.2M subscribers)

- Mark Rober (20.4 subscribers)

- Kallmekris (4.24M subscribers)

- Technoblade (9.4M subscribers)

- The Royalty Family (15.4M subscribers)

US Top Shorts Creators

- Zhong (5.98M subscribers)

- Desmond Dennis (3.93M subscribers)

- Dental Digest (6.11M subscribers)

- Greg Renko (3.45M subscribers)

- Nick DiGiovanni (3.74M subscribers)

- The Bentist (2.25M subscribers)

- Milad Mirg (2.48M subscribers)

- SeanDoesMagic (4M subscribers)

- Dylan Lemay (2.62M subscribers)

- DankScole (1.79M subscribers)

- Lisa Nguyen (2.49M subscribers)

- Jeenie.Weenie (2.66M subscribers)

- Jacob Colvin (3.33M subscribers)

- Ian Boggs (2.81M subscribers)

- The Beverly Halls (2.44M subscribers)

US Top Music Videos

- Pooh Shiesty: Pooh Shiesty - Back In Blood (feat. Lil Durk) [Official Music Video]

- TheWeekndVEVO: The Weeknd - Save Your Tears (Official Music Video)

- LilNasXVEVO: Lil Nas X - MONTERO (Call Me By Your Name) (Official Video)

- PoloGVEVO: Polo G - RAPSTAR (Official Video)

- DJKhaledVEVO: DJ Khaled - EVERY CHANCE I GET (Official Music Video) ft. Lil Baby, Lil Durk

- HSM: MO3 & OG Bobby Billions - Outside (Better Days) (Official Video)

- Bruno Mars: Bruno Mars, Anderson .Paak, Silk Sonic - Leave the Door Open [Official Video]

- Cardi B: Cardi B - Up [Official Music Video]

- OliviaRodrigoVEVO: Olivia Rodrigo - drivers license (Official Video)

- Rod Wave: Rod Wave - Street Runner (Official Video)

Breakout Creators

- Kallmekris (4.24M subscribers)

- Ranboo (3.71M subscribers)

- Adin Live (2.21M subscribers)

- Beluga (6.1M subscribers)

- Ryan Trahan (4.96M subscribers)

- TapL (3.57M subscribers)

- Kinigra Deon (1.48M subscribers)

- Tubbo (3.01M subscribers)

- BrentTV (1.8M subscribers)

- Casual Geographic (1.51M subscribers)

Source

Are we in a recession here s what your grandma s looked like in the 70 s are we in a recession here s what a 2 million retirement looks like in america are we in a recession here s what s happening are we in a recession today are we in a recession in america are we in a simulation are we in a retrograde right now are we going to war

Are We in a Recession? Here's What You Should Know About Layoffs, Debt and Investing

This story is part of Recession Help Desk, CNET's coverage of how to make smart money moves in an uncertain economy.

What's happening

Based on the latest numbers, the US is in a period of decline -- possibly even a recession.

Why it matters

Recessions are historically marked by a period of widespread layoffs, bankruptcies, higher borrowing costs and turbulence in the stock market.

What's next

Gather facts to protect your financial position. No one can predict the future, and it's important to move calmly and deliberately.

A recession is top of mind for many Americans. But how do we know if we're in one? Technically, the country is in a recession when gross domestic product, the value of all goods and services produced during a specific period, falls during two quarters back to back. Last week's results proved this was the case: GDP dropped by 1.6% in Q1 and 0.9% in Q2, according to the advanced estimate by the Bureau of Economic Analysis.

While all signs point to a recession, in the US, this is determined by the National Bureau of Economic Research -- and it has not called a recession yet.

But whether we can call this period a recession or not feels like a game of semantics.

Ultimately, everyday Americans are struggling as prices continue to soar, the cost of borrowing rises and layoffs increase across the country. Here are some recent questions I answered for my So Money podcast audience about how best to prepare, save, invest and make smart money moves in these uncertain times.

What can we expect in a recession?

It's always helpful to go back and review recession outcomes so that we can manage our expectations. While every recession varies in terms of length, severity and consequences, we tend to see more layoffs and an uptick in unemployment during economic downturns. Accessing the market for credit may also become harder and banks could be slower to lend, because they're worried about default rates.

Read more: The Economy Is Scary. Here's What History Tells Us

As the Federal Reserve continues to raise rates to try to clamp down on inflation, we'll see an even greater increase in borrowing costs -- for mortgages, car loans and business loans, for example. So, even if you qualify for a loan or credit card, the interest rate will be higher than it was in the prior year, making it harder for households to borrow or pay off debt. We're already seeing this in the housing market, where the average rate on a 30-year fixed mortgage was recently approaching nearly 6%, the highest level since 2009.

During recessions, as rates go up and inflation cools, prices on goods and services fall and our personal savings rates could increase, but that all depends on the labor market and wages. We may also see an uptick in entrepreneurship, as we saw in 2009 with the Great Recession, as the newly unemployed often seek ways to turn a small business idea into reality.

Will layoffs become more common?

With the unemployment rate sitting at 3.6%, the job market may appear to be, at least right now, the only stable part of the economy. But that's likely to be temporary, as companies battling with the current financial headwinds -- including inflation, rising interest rates and weakening consumer demand -- have already begun to announce layoffs. According to Layoffs.fyi, a website that tracks job losses at tech startups, there were close to 37,000 layoffs from startups in the second quarter of 2022. This week, Shopify announced reducing its workforce by about 10% or roughly 1,000 layoffs. CEO Tobi Lutke said the e-commerce company's pandemic-driven growth plans "didn't pay off."

In the Great Recession, unemployment peaked at 10%, and it took an average of eight to nine months for those out of work to secure a new job. So now could be the time to review your emergency fund if you think there's a shortfall. If you won't be able to cover a minimum of six to nine months' worth of expenses, which is hard for most people, see if you can accelerate savings by cutting back on spending or generating extra money. It's also a good time to make sure your resume is up to date and to establish contact with influential individuals in your professional and personal network. If you are laid off, make sure to apply for unemployment benefits right away and secure your health insurance.

If you're self-employed and worried about a possible downturn in your industry or a loss of clients, explore new revenue streams. Aim to bulk up your cash reserves as well. Again, if previous recessions taught us anything, it's that having cash unlocks choices and leads to more control in a challenging time.

Will interest rates on my loans and debts go up?

As the Federal Reserve continues to raise interest rates to try to curb inflation, adjustable interest rates are set to increase -- ratcheting up the APRs of credit cards and loans, and making monthly payments more expensive. Ask your lenders and card issuers about low-interest credit options. See if you can refinance or consolidate debts to a single fixed-rate loan.

In past recessions, some financial institutions were hesitant to lend as often as they did in "normal" times. This can be troubling if your business relies on credit to expand, or if you need a mortgage to buy a house. It's time to pay close attention to your credit score, which is a huge factor in a bank's decision. The higher your score, the better your chances of qualifying and getting the best rates.

Should I stop investing in my 401(k)?

With stocks in a downward spiral, many want to know how a recession could impact their long-term investments. Should you stop investing? The short answer is no. At least, not if you can help it. Avoid panicking and cashing out just because you can't stomach the volatility or watch the down arrows during a bear market.

My advice is to avoid making knee-jerk reactions. This may be a good time to review your investments to be sure that you're well-diversified. If you suddenly experience a change in your appetite for risk for whatever reason, talk it through with a financial expert to determine if your portfolio needs adjusting. Some online robo-advisor platforms offer client services and can provide guidance.

Historically, it pays to stick with the market. Investors who cashed out their 401(k)s in the Great Recession missed out on a rebound. Despite the recent downtick, the S&P 500 has risen nearly 150% since its lows of 2009, adjusted for inflation.

The one caveat is if you desperately need the money you have in the stock market to pay for an emergency expense like a medical bill, and there's no other way to afford it. In that case, you may want to look into 401(k) loan options. If you decide to borrow against your retirement account, commit to paying it back as soon as possible.

Should I wait to buy a home?

With mortgage rates on the rise and housing prices not cooling nearly fast enough, owning could be more expensive than renting right now. A report from the John Burns Real Estate Consulting firm looked at the cost to own versus renting across the US in April and found that owning costs $839 a month more than renting. That's nearly $200 greater than at any point since the year 2000.

Fixed rates on 30-year mortgages have practically doubled since last spring, which has helped slow down offers and cool housing prices -- but competition among buyers is still stiff due to historically low inventory. All-cash offers and bidding wars continue in plenty of markets. If you've been shopping for a home in recent months or the past year to no avail, you may feel exhausted and defeated.

As I stated in my newsletter: Don't be hard on yourself. You're not doing anything wrong if you have yet to offer the top bid. While it's true that a fixed-rate mortgage can offer you more predictability and budget stability, as long as inflation continues to outpace wages, there could be some bright sides to renting right now. For one, you're not buying a home in a bubble market that some economists are saying is soon to burst. If you have to unload the home in a year or two -- during a possible recession -- you may risk selling at a loss.

Secondly, renting allows you to hold onto the cash you would have spent on a down payment and closing costs, and will help you stay more liquid during a time of great uncertainty. This allows you to pivot more quickly and secure your finances in a downturn. Remember: Cash is power.

Read more: Should You Buy a Home in 2022 or Wait? 3 Factors to Consider

My final note is that it's important to remember that recessions are a normal part of the economic cycle. Long-term financial plans will always experience some declining periods. Since World War II, the US has had about a dozen recessions and they typically end after a year or sooner. By contrast (and to give you some better news), periods of expansion and growth are more frequent and longer lasting.

Source

Should you buy used or new car should you buy used shoes should you buy used mattress should you buy your leased car should you buy gap insurance should you buy extended warranty how much water should you drink a day how much protein should you have a day how long should you keep tax records how long should you quarantine after covid 19

Should You Buy Used Camera Gear?

If you're looking to save some money and don't need the latest and greatest, it's worth considering buying used camera gear. Whether it's for a summer vacation, a road trip or you just want something that's better than your phone, a great camera at a not-quite-new price is the best of all worlds.

And it's not just the cameras themselves. Lenses and many accessories are also available used. I'm not talking about eBay... or at least, not exclusively: There are a variety of ways to get used camera gear that's been tested by professionals so you know exactly what you're getting.

Is it worth the risk? I thought so. I've bought a variety of used camera gear in the last few years, including most recently an $1,100 lens in like-new condition for 30% off. Here's what to consider and where to look.

Options

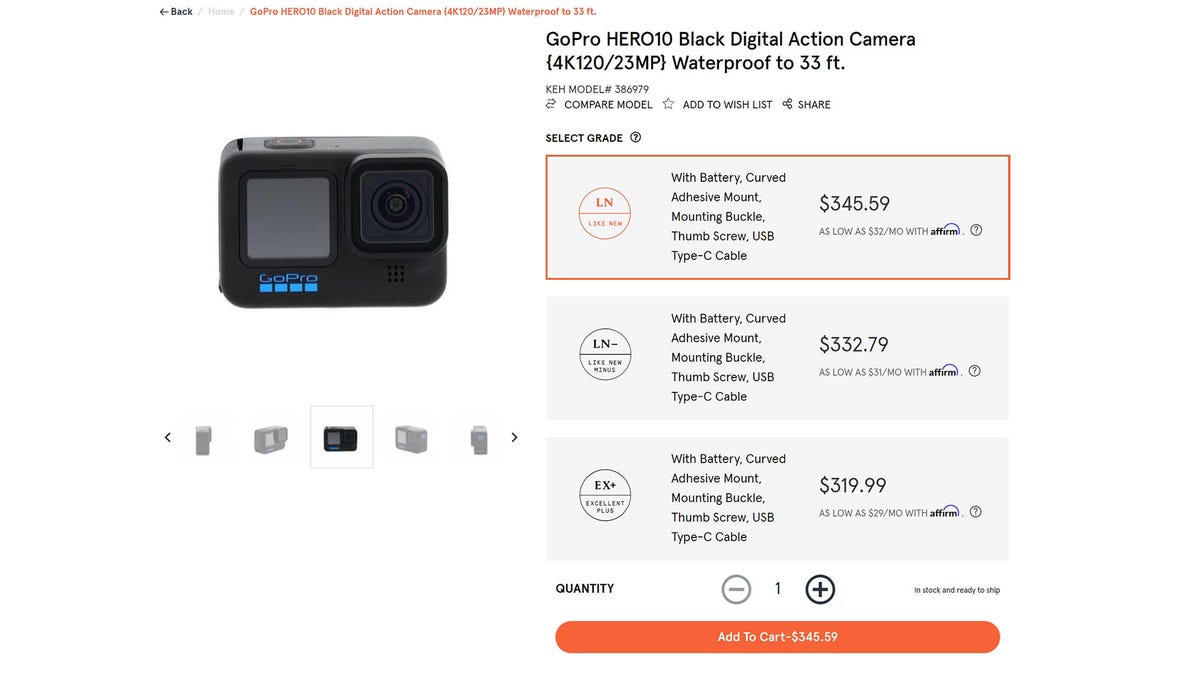

Three used GoPro Hero 10 action cameras on KEH.com. For reference, the Hero 10 is $500 new.

CNET/KEHIf you have a local camera shop, that's ideal so you can physically look at the camera/lens/whatever and make sure it works, doesn't have peanut butter smeared in the battery compartment, and so on. I actually drove out of my way on my 10,000-mile road trip last year to visit a used camera store so I could sell my old gear and buy a new Canon R6 and a used Sigma 50mm f1.4. However, this is not feasible for most people.

So what about the web? If you've visited eBay at all in the last few years you'll have noticed the vast majority of sellers are companies hawking their wares. You can find person-to-person sales, sure, but they're quite outnumbered. I mention eBay first as it's the website that's probably top of mind when most people think "buying used on the internet." Personally, I'd never buy expensive gear on eBay, because you never know what you're going to get until it arrives. The same is true of Craigslist, which offers the added bonus (terror) of meeting the seller in person.

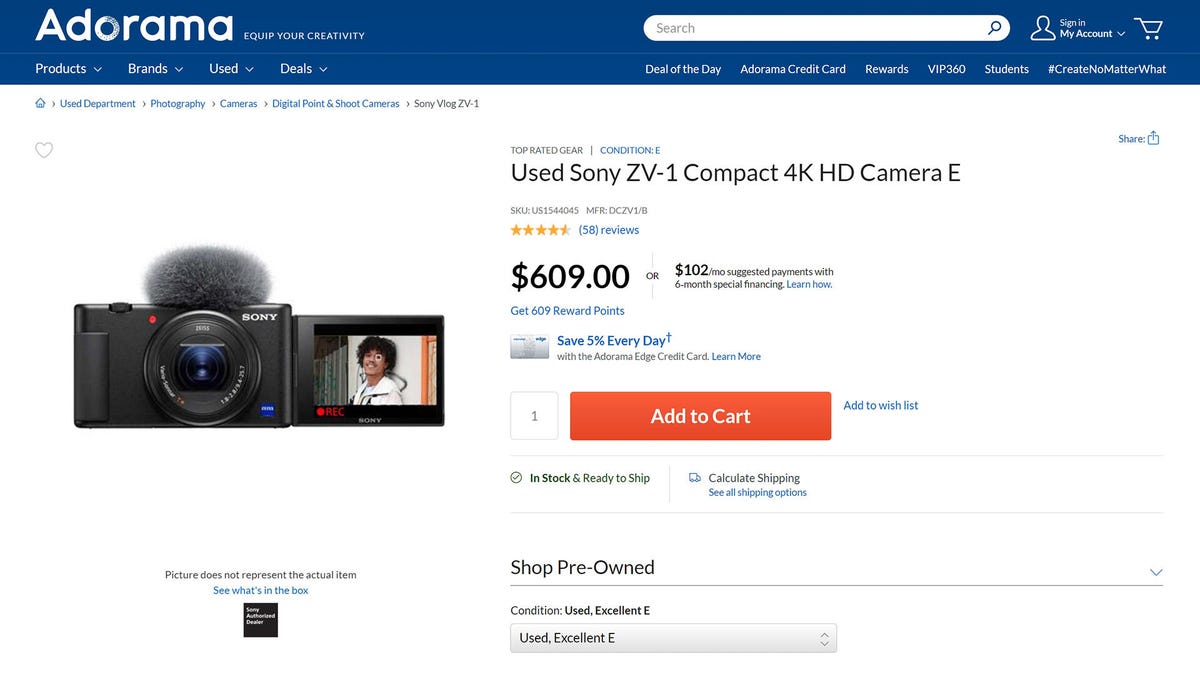

A listing for the Sony ZV-1 on Adorama. For reference, the ZV-1 is $750 new.

Adorama/CNETWhat's needed is a filter or a middleman that can look at the used gear, judge its fitness and sell it. Fancy car companies call this "certified pre-owned." Fortunately, there are several websites that do exactly this: Examples include KEH Camera, MPB and LensRentals. Most of these sites either have pictures of the actual item, a description of what appraisers found or both. Some other companies, like Adorama and B&H, include used options alongside their new offerings.

Beyond the camera-speciality realm, there's also Amazon's dedicated Amazon Renewed program. What's notable there is a 90-day satisfaction guarantee. (Keep in mind that's not for any used items or third-party Marketplace items on Amazon, only items in the Amazon Renewed program.)

How it works

Most sites have info about the specific item you're considering, but MPB has photos of it, which is rare.

A screenshot of a Sony camera on the MPB website.I had a lens I wanted to sell as I'd never used it. I had also fixated on getting another lens for my current camera. (Don't get into photography, kids. It's expensive.) I decided to check out the used camera gear sites.

First, selling. The process is similar on each. You put in the brand and model of what you're selling along with a general appraisal of its condition (good, OK, peanut-butter smeared, etc.). You're then given a quote/estimate of what the company will pay you for the product. (In my case, a lens.) I went with the site that gave me the best estimate, obviously, and it emailed me a label I could print out for shipping. The cost of this shipping must be included in their pricing as there is no separate shipping charge.

After a brief time in transit, I got an email saying they'd received it. A few days after that I got a final quote, which I accepted; it was for slightly less than the original quote, which I deemed fair based on the lens' condition. A few days after that, the money hit my PayPal. It was exceptionally easy, so it's certainly worth seeing if any of your older gear is worth selling.

KEH's grading system.

KEH/CNETBuying is, with one addition, like buying anything else online. That addition varies a bit with each site. It's how, and how elaborately, they explain the condition of the used gear. For instance, KEH uses an 8-point scale, as seen in the image above. LensRentals has a 4-point scale. MPB goes all out and actually photographs the specific piece of gear you're considering.

B&H's rating system

B&H/CNETI ended up going with KEH for both as they had the highest price for the one I was selling and lowest for the one I was buying. That price difference is going to vary depending on the gear, so it's absolutely worth checking all the sites for the best deal.

Weighing the risks

The obvious risk is the gear not working as promised. With most websites and on most gear there is a return policy, often a few weeks. So if it doesn't work or look as described, you can return it.

Then there's the question about longevity of gear that's already been used, perhaps heavily. There's no way to know this risk: That's the price you pay to get lower prices. This is mitigated somewhat by the inspection process you're paying these middlemen for, when you could theoretically get the same gear for less direct from someone selling it used.

There likely won't be any manufacturer's warranty. If something does go wrong, you'll have to pay to fix it. Even if you get something within the manufacturer's warranty window, since you didn't buy it new they likely won't honor it. Since you didn't buy it new from a licensed dealer, it's possible the manufacturer won't fix it even if you're willing to pay. However, you should still be able to get it repaired at a third-party repair place.

Certain sites will offer their own short-term warranty on gear they sell to you. KEH and MPB each come with six months, while Amazon Renewed and LensRentals products have three. You might also be able to buy an extended warranty from the website, though read the details about what these cover.

Is it worth it?

If you have old cameras or lenses laying around it's worth seeing if it's worth anything. It might partially or fully pay for new gear!

GettyImages/Ozgur DonmazPersonally, I've had good luck with used gear. Then again, I've bought lenses (and they tend to last a long time). If the price was right I'd probably buy a GoPro if it was in good condition, since most people use them for Disney vacations and not wingsuiting through canyons or whatever this is.

I'd also check used sites for any accessories, with the exception of batteries. There's no telling how poorly a battery's been treated.

Would I buy a used, full-size expensive camera? I don't think so. I think for something I couldn't easily replace if it was damaged I'd want a warranty and the peace of mind that it was all new parts... and any damage done was only the result of my own clumsiness.

However, that's all a personal calculation. Saving dozens, perhaps hundreds of dollars against the chance that something might not last as long as a new one could be worth it. Just go in with your eyes open. If the price seems too good to be true, it almost certainly is.

As well as covering TV and other display tech, Geoff does photo tours of cool museums and locations around the world, including nuclear submarines, massive aircraft carriers, medieval castles, epic 10,000-mile road trips, and more. Check out Tech Treks for all his tours and adventures.

He wrote a bestselling sci-fi novel about city-size submarines, along with a sequel. You can follow his adventures on Instagram and his YouTube channel.

Source

Dji om 5 gimbal stabilizer dji om 5 smartphone gimbal stabilizer review dji om 5 handheld gimbal dji om 5 gimbal review dji om 4 handheld foldable stabilizer dji om 4 handheld foldable stabilizer dji om 5 stabilizzatore dji pocket 2 refurbished dji store dji spark dji smart controller dji spark battery

DJI's compact, folding OM 5 stabilizing gimbal for iPhone and Android

1 of 12 Andrew Hoyle/CNET

DJI's latest phone gimbal, the OM 5, uses a clever folding system and magnetic phone clamp to pack down to a pocketable size. Add to that a solid battery life, impressive performance and a neat built-in extending selfie stick. The OM 5 is a great choice for mobile creatives wanting to shoot better looking video without carrying a big camera setup with them.

The DJI OM 5 is available now worldwide and will set you back $159 ( £140, AU$239).

2 of 12 Andrew Hoyle/CNET

There aren't many buttons to confuse you on the handle, but the few that are there are easily within thumb reach.

3 of 12 Andrew Hoyle/CNET

The phone attaches to the gimbal using this magnetic clamp. It helps keep the size of the gimbal down when it's packed away while the clamp's slim profile means you can keep it on your phone, ready to shoot, without it getting in the way.

4 of 12 Andrew Hoyle/CNET

If you want to upgrade the clamp you can opt for version with built-in LED lights to help brighten up your face when shooting selfies in dark conditions. It's an extra $59 (£42, AU$79) so won't be for everyone, but it might make all the difference if you're always shooting in the dark.

5 of 12 Andrew Hoyle/CNET

The OM 5 does a great job at smoothing out your phone footage, eliminating all but the worst of your shaky hand movements.

6 of 12 Andrew Hoyle/CNET

It charges over USB C and offers around 6 hours of use from a single charge.

7 of 12 Andrew Hoyle/CNET

If you shoot a lot of video with your phone but you've never tried a gimbal then it's well worth giving it a go. I've been surprised at the difference it makes.

8 of 12 Andrew Hoyle/CNET

The OM 5 comes with a mini tripod in the box. It can act either as an extension to the handle or as a regular tripod keeping the gimbal in place during long time-lapses.

9 of 12 Andrew Hoyle/CNET

You can also shoot video in vertical format if you're looking for TikTok fame.

10 of 12 Andrew Hoyle/CNET

There's a built-in extending selfie stick, which is great for getting better selfies or for more creative shooting angles.

11 of 12 Andrew Hoyle/CNET

I had no problem keeping the magnetic mount on my phone while it was in my pocket. Then, when creativity strikes, I just slap it straight onto the gimbal and I'm ready to shoot.

12 of 12 Andrew Hoyle/CNET

The whole thing folds down into a compact format that's easy to fit into a large jacket pocket, meaning it's always on hand to shoot with.

Source

Apple watch 7 review a slight upgrade compared with crossword apple watch 7 review a slight upgrade compared in spanish apple watch 7 review a slight upgrade compared with felix apple watch 7 review a slight upgrade mac apple watch 7 review a slight trick apple watch 7 review a slight edge apple watch 7 review a slight definition apple watch bands apple watch series 3

Apple Watch 7 review: A slight upgrade compared to last year's smartwatch

Editor's note, Nov. 2: The Apple Watch Series 7's larger screen and faster charging make an already great smartwatch even better, which is why we've given it a CNET Editors' Choice Award. Our original review follows.

The Apple Watch has long been considered the gold standard of smartwatches, and that holds true with the Series 7. There isn't much that separates it from the Series 6, but that's not necessarily a drawback. The Series 6 already offered a polished software experience, sleek design and plenty of useful fitness features, and Apple has further refined those attributes with the Series 7.

It introduces a larger screen with a QWERTY keyboard for the first time, new color options, faster charging and improved durability for the same price as the Series 6. Of course, it's not perfect -- the battery life hasn't improved, and Apple's sleep tracking still generally lags behind the competition. But it's undoubtedly the best smartwatch for iPhone owners, which is why we give it the best ranking.

While the enlarged screen is the Series 7's most significant change, there are a few other update worth noting. The design is more durable and dust resistant for the first time, it can charge up to 33% faster than the Series 6 and the aluminum casing comes in new color options.

Otherwise, the Apple Watch Series 7 has all the same goodies as the Series 6, including the more premium features missing from the Apple Watch SE like blood oxygen saturation measurements, an always-on display and the ability to take ECG measurements from the wrist.

To put it bluntly, the Series 7 doesn't feel like the type of generational upgrade we've come to expect from Apple's smartwatches in years past. But that's not necessarily a snub against it.

The Series 7 feels more like a refined version of a watch we already love -- the Series 6 -- rather than a major upgrade. And since it's the same price as its predecessor, the Series 7 is a promising option for first-time Apple Watch buyers or those upgrading from an older watch.

If you have a Series 6 or a Series 5, don't spend $400 on the Series 7. But if you have an aging model like the Series 3, Apple's latest watch will feel like a noticeable leap forward.

A new design with a bigger screen

The Apple Watch Series 7's biggest update is its larger screen.

Lisa Eadicicco/CNETThe Series 7's larger display is the biggest change that differentiates it from the Series 6. Apple has reduced the size of the borders that frame the screen to allow for a more spacious display without meaningfully changing the casing's dimensions.

As a result, the Apple Watch Series 7 comes in 41-millimeter and 45mm size options, compared to the Series 6 which was available in 40mm and 44mm casings. The watch itself is technically a little heavier too; the aluminum 41mm model weighs 32 grams compared to the 30.5-gram 40mm Series 6. However, this wasn't noticeable while wearing the watch.

Read more: Best Apple Watch Series 7 Cases

The Series 7 also has IP6X dust resistance and a front crystal cover that's more than 50% thicker, although I haven't had the opportunity to put that to the test just yet. But the Series 7 held up just fine when CNET senior video producer Chris Parker tested its dust and water resistance, which you can learn more about in the video below.

The corners are also softer and more round, but you can really only notice this when examining the watch very closely. The aluminum model also comes in five new colors: midnight, starlight, green and updated blue and red options that are lighter compared to the shades that were available for the Series 6. I've been wearing the starlight model, which is like a blend of gold and silver.

You might be wondering why you even need a larger screen on a device like the Apple Watch, which is meant for short glanceable notifications rather than long interactions. Apple has made a few attempts at answering that question by redesigning the watch's user interface to make sense of its bigger screen.

Buttons in apps like timers, alarms and the calculator have been enlarged so that they're easier to tap. The most useful change in this sense is the keypad for unlocking your watch. Now that the buttons are larger, I can type in my passcode correctly on the first try when putting on my watch in the morning even when I'm in a hurry.

You can also see a couple of extra lines of text on screen when reading news clips or notifications. While it's a noticeable improvement, it didn't meaningfully change how I use the Apple Watch since I don't typically do a lot of reading on its screen.

The Series 7 also includes new font size options for making text appear even larger on screen, which could be particularly useful for watch owners with visual impairments.

The Apple Watch finally gets its first real keyboard

The Apple Watch Series 7 is the first to get a QWERTY keyboard.

Lisa Eadicicco/CNETHowever, the new QWERTY keyboard is the real reason you'll benefit from the Series 7's larger screen. In apps like Messages or Mail, simply tap the message field when creating a new text or email to pull up the keyboard. If you don't see the keyboard right away, you can use the arrow at the bottom of the screen to switch between the keyboard option or Scribble, which lets you trace individual letters with your finger.

The keyboard's autocorrect functionality works surprisingly well, which is important on such a tiny keyboard where it's difficult to be precise. I was impressed by the way it often correctly completed my words before I had finished typing, even when I was typing something very specific like a friend's name.

This really came in handy when I attended a close friend's wedding recently as a bridesmaid. There were several occasions in which I needed to coordinate with other wedding party members but didn't have my phone nearby. Instead of running down the hallway in my heels to grab my phone from the bridal suite, I sent a quick message to my husband that said "Come down to the lobby," when I had some down time between photo shoots.

I've mostly been using the QuickPath feature, which lets you type by swiping between letters, since it's much easier to slide my finger across the Series 7's keyboard rather than pecking individual keys.

Of course, you could also use the watch's dictation feature to send messages without reaching for your phone. But not everyone feels comfortable talking into their watch in public and there may be times when a message is simply too private to dictate out loud.

It's great to finally have a native text input method on the Apple Watch that's feasible for typing out full words and sentences, unlike the Scribble feature. That being said, if you're typing anything more than a short phrase like "Meet me downstairs," or "Don't forget the milk," it's best to use your phone.

Typing on the watch requires too much concentration for lengthy sentences. I also often found myself deleting full words when I meant to only erase one character, which can be frustrating. (You can change this in the watch's settings or use the digital crown to move the cursor more precisely).

New watch faces show how the bigger screen can be useful, but there should have been more

The Apple Watch Series 7 has a new Contour watch face designed for its larger screen.

Lisa Eadicicco/CNETWatch faces are a big part of the Apple Watch experience since it's the screen you look at the most. With that in mind, it's no surprise that Apple has added new watch faces designed specifically for the Series 7's bigger display. There's the Modular Duo face, which is the first to have two large-format complications for displaying information and Contour, a face featuring numerals that bleed over the Series 7's curved edges.

I personally preferred the Modular Duo face since getting as much information as possible in a quick glance is more important to me than aesthetics. With the Modular Duo face, I'm able to see the time, a breakdown of my activity progress over the course of the day, the temperature and hourly weather forecasts just by looking down at my wrist. The regular Modular face available on the Series 6 and earlier, by comparison, only lets you add one large complication and several small ones.

I only wish there were more faces to choose from that have been specially designed for the Series 7 -- especially since the larger screen is its most significant upgrade. Hopefully we'll see more new watch faces arrive in future software updates.

The other major change Apple has made to the display is increasing its brightness in always-on mode while indoors. That means when your wrist is down and the display is inactive, the Series 7's screen will shine brighter than the Series 6's and the Series 5's. It's definitely noticeable when comparing the Series 7 and Series 6 side-by-side, but it doesn't make a substantial difference in the way I use my watch. Consistent with my overall thoughts on the Series 7, the brighter always-on display is a refinement rather than a major upgrade.

Faster charging but the same battery life

The Apple Watch Series 7's new charger enables it to charge 33% faster than the Series 6.

Lisa Eadicicco/CNETWhen it comes to battery life, there's good news and bad news. The good news is that the Series 7 can charge considerably faster than the Series 6, which is useful if you use the watch for sleep tracking or simply forget to charge it overnight. The bad news: The Series 7's battery life hasn't improved compared to the Series 6.

Let's start with the good. Apple says the new watch should charge up to 33% faster than its predecessor thanks to changes made to the watch's internals and a new charger that comes in the box.

I found this to be accurate during my testing, but only when charging the watch for at least a half hour. After 30 minutes of charging, the Apple Watch Series 7's battery jumped from zero to 54%, while the Series 6's only replenished by 37% in the same time period. For consistency, I used the same charger for both watches.

That's a big difference and those who charge up their watch during their morning routine before leaving the house will surely appreciate it. But if you only have a few spare moments to power up your watch, there isn't much of a difference in charging speed between the Series 6 and Series 7. After charging both watches on the same charger for 15 minutes, the Series 7's battery was at 24% while the Series 6's was at 23%.

The other downside is that this only works with Apple's new charger. That means if you have a charging dock with a built-in Apple Watch charger like Apple's MagSafe Duo, you won't be able to take advantage of the Series 7's speedier power-up process. However, the faster charger will work with any USB-C compliant wall adapter, whether it's made by Apple or not.

Apple also hasn't improved the Apple Watch's battery life with the Series 7. Like its predecessor, the Series 7 should last for 18 hours on a single charge according to Apple's estimates. Instead of improving the watch's overall battery life, Apple is seemingly trying to make topping off the battery throughout the day easier so that you don't have to charge it overnight.

Battery life will always vary depending on how you use your watch, but I've found that the Series 7 and Series 6 generally last for about a day and a half with the always-on display setting turned on. Activities like running with GPS will cause it to drain faster.

Considering Fitbit watches like the Versa 3 and Sense offer multiday battery life, it would have been nice to see Apple make some advancements on this front. That's especially true since Apple is now positioning the Apple Watch as a sleep tracker. There's a lot of room for the Apple Watch to improve as a sleep tracker, which Apple has proven by adding new metrics such as sleeping respiratory rate in WatchOS 8. I'm just disappointed it didn't extend battery life to match.

The same sensors and health tracking as the Series 6

The Apple Watch Series 7 has the same health tracking features as the Series 6.

Lisa Eadicicco/CNETAside from these changes, the Series 7 has a lot in common with the Series 6. The Series 7 runs on a new S7 system-on-a-chip, but offers the same performance as the Series 6.

Both watches have support for blood oxygen saturation measurements, the ability to take an ECG from the wrist, heart rate measurements with high and low heart rate notifications, a compass for more precise location tracking, an always-on altimeter for measuring elevation, fall detection, Apple's U1 chip that helps the watch function as a digital car key, emergency SOS and international emergency calling. That's in addition to features that have been in the Apple Watch for years, like Apple Pay.

In fact, you don't even need the latest Apple Watch to get many of the device's latest features. Apple's WatchOS 8 software, which launched on Sept. 20, brings a bunch of new capabilities to watches as old as the Series 3.

These include more advanced fall detection that can tell if you've taken a tumble from a specific type of workout like cycling, the ability to store digital versions of your ID and house key on the watch, the ability to use Portrait mode photos as your watch face and a new Mindfulness app that replaces the Breathe app. The same selection of workout modes and compatibility with Apple Fitness Plus is also available across Apple Watch models.

It's important to note, however, that not all the new features in WatchOS 8 are available on all models that support the software. A feature that detects when you start cycling and prompts you to begin a workout on the watch is only available on the Apple Watch SE, Series 6 and Series 7, while the updated fall detection only works on the Series 4 or later.

The bottom line: A small improvement from the Series 6

The Apple Watch Series 6 (left) alongside the Apple Watch Series 7 (right).

Lisa Eadicicco/CNETOverall, the Apple Watch Series 7 feels more like a theoretical Apple Watch 6S rather than a major year-over-year upgrade. Apple isn't bringing anything entirely new to the health experience with the Series 7 as it did with last year's Series 6, which was the first Apple Watch to support blood oxygen saturation measurements.

There are pros and cons to that approach. I'm glad Apple isn't just adding new health features for the sake of outpacing the competition. My biggest criticism about new wellness capabilities from Fitbit and Amazon -- such as Fitbit's app for testing your body's reaction to stress and Amazon's body-scanning tech that estimates body fat percentage -- is that there isn't enough direction about how to interpret these readings. Without knowing what to do with that information, it's hard to know how these data points can be helpful. So in that regard, it's great to see Apple expanding the watch's health tracking capabilities in more practical and straightforward ways, such as by adding better fall detection and new workout options with WatchOS 8.

But at the same time, I would have liked to see more from the Series 7. Longer battery life is always on my wishlist, but Apple could have also done more to leverage the Series 7's existing technology. A broader selection of new watch faces designed to take advantage of the Series 7's larger screen would have been nice. And more than a year later, I'm still not entirely sure what to make of the results from the watch's blood oxygen sensor. We also expected to see an upgraded U1 ultrawideband chip in the Series 7 per a Bloomberg report that was published ahead of the watch's launch, but that didn't arrive either.

All told, the Apple Watch Series 7 is essentially a more refined version of the Series 6. If you already have a recent watch like the Series 5 or 6, there's no reason to upgrade just yet -- especially since you can get many new features through software updates. But if you have an older watch like the Series 3 or Series 4, you'll have a lot to gain from the bigger screen, speedier performance and additional sensors that come with the Series 7.

Apple Watch Series 7 vs. Series 6, SE, Series 5, Series 3

| | Apple Watch Series 7 | Apple Watch Series 6 | Apple Watch SE | Apple Watch Series 5 | Apple Watch Series 3 |

|---|---|---|---|---|---|

| Size | 41mm/45mm | 40mm/44mm | 40mm/44mm | 40mm/44mm | 38mm/42mm |

| Display | Always-on Retina display with nearly 20% more screen area than Series 6 | Always-on Retina display | Retina display | Always-on Retina display | Retina display |

| Display resolution | 352 x 430 (41mm), 396 x 484 (45mm) | 324 x 394 (40mm); 368 x 448 (44mm) | 324 x 394 (40mm); 368 x 448 (44mm) | 324 x 394 (40mm); 368 x 448 (44mm) | 272 x 340 (38mm); 312 x 390 (42mm) |

| Durability | Water resistance; IP6X dust resistance | Water resistance | Water resistance | Water resistance | Water resistance |

| Sensors | Blood oxygen, electrical heart, third-gen optical heart, compass, always-on altimeter, fall detection, accelerometer, gyroscope, GPS/GNSS, ambient light | Blood oxygen, electrical heart, third-gen optical heart, compass, always-on altimeter, fall detection, accelerometer, gyroscope, GPS/GNSS, ambient light | Second-gen optical heart, compass, always-on altimeter, fall detection, accelerometer, gyroscope, GPS/GNSS, ambient light | Second-gen optical heart, electrical heart, compass, barometric altimeter, fall detection, accelerometer, gyroscope, GPS/GNSS, ambient light | Optical heart, barometric altimeter, accelerometer, gyroscope, GPS/GNSS, ambient light |

| Processor | S7 | S6 | S5 | S5 | S3 |

| Colors and finishes | Aluminum: midnight, starlight, green, blue red; stainless steel: silver, graphite, gold; titanium: natural, space black | Aluminum: silver, space gray, gold, blue, red; stainless steel: silver, graphite, gold; titanium: natural, space black | Aluminum: space gray, silver, gold | Aluminum: silver, space gray, gold; stainless steel: stainless steel, space black, gold; titanium: natural, space black; ceramic: white | Aluminum: space gray, silver |

| Battery Life | Up to 18 hours with 33% faster charging than Series 6 | Up to 18 hours | Up to 18 hours | Up to 18 hours | Up to 18 hours |

| Storage | 32GB | 32GB | 32GB | 32GB | 8GB |

| Connectivity | Wi-Fi, Bluetooth 5.0, W3 wireless chip, U1 chip, emergency SOS, international emergency calling, optional LTE | Wi-Fi, Bluetooth 5.0, W3 wireless chip, U1 chip, emergency SOS, international emergency calling, optional LTE | Wi-Fi, Bluetooth 5.0, W3 wireless chip, emergency SOS, international emergency calling, optional LTE | Wi-Fi, Bluetooth 5.0, W3 wireless chip, emergency SOS, international emergency calling, optional LTE | Wi-Fi, Bluetooth 4.2, W2 wireless chip, emergency SOS |

Source

Best money tips for gen xers in a shaky foundation best money tips for gen xers parents best money tips for gen xers years best money tips for genji best travel money tips best money management tips best money making tips best saving money tips best money markets best money management software best money clips for men best money making apps

Best Money Tips for Gen Xers in a Shaky Economy

This story is part of So Money (subscribe here), an online community dedicated to financial empowerment and advice, led by CNET Editor at Large and So Money podcast host Farnoosh Torabi.

Wedged in between millennials and baby boomers, Generation X (of which I consider myself a proud member) has been somewhat overlooked when it comes to financial advice. And you probably feel flat-out ignored as a person of color within this demographic. If you were born between the mid-1960s and 1980, you're often assumed to have plenty of savings, a robust retirement plan and no money conundrums or debt.

Well, not really. We also struggle at critical junctures.

On the one hand, Gen X has managed to keep its head above financial water more than older and younger generations. Gen Xers were hit particularly hard during the Great Recession, but were the only generation of households to recover wealth they lost between 2007 and 2010, with many fortunate enough to hold on to assets and continue working, according to Pew Research,

Our generation also paid less for college than millennials (born 1981 to 1996) and Generation Z (born 1997 to 2012). In 1995, the average annual cost to attend a four-year institution came out to a little more than $10,000, compared to $28,000 today. And chances are we didn't enter a deep recession upon graduating.

Still, the journey has been anything but linear or painless for Gen Xers. Though we may not need as much advice on consolidating our student loans, getting married or divorced, raising kids or taking care of aging parents, we could use some tailored financial advice and outside-the-box strategies, especially in today's economy.

"We are really at the moment in our careers and our lives where everything is happening, whether that is in our jobs, in our relationships … I don't want to be a downer but… it's a lot," said publisher Margit Detweiler. Detweiler is the founder of TueNight.com, a storytelling platform for, as she describes it, "grown ass Gen X women."

Financial advice for my fellow Gen Xers could span several books, but let's start with these five steps.

1. Career: Don't give up, even when it's tough

For now, the job market is still considered "hot" with unemployment at 3.6%, close to its pre-pandemic low. But recently, as concerns about a possible recession ramp up, we've seen more job cuts and hiring freezes. So far, the bulk of layoffs are primarily in industries that saw growth at the beginning of COVID-19 shutdowns and are now facing waning consumer demand.

If you lose your job in your 50s, it may feel impossible to secure employment. But don't give up. Consider extending your job search to other types of businesses. For example, there is a higher rate of job openings right now in hospitality, food service, education, health and wholesale and retail trade, according to a June report by the US Chamber of Commerce.

And if you've been climbing in your career for a decade or two but are reaching a plateau, be inspired by the many examples of individuals who made big leaps in their careers or pivoted to entrepreneurship later in life. Julia Child, for example, wrote her first cookbook, Mastering the Art of French Cooking, at age 49, following years in the advertising profession. Viola Davis spent decades working as a performer before her career soared in her early 40s, when she starred in the film Doubt and was nominated for an Academy Award for her role.

2. Retirement: Turbocharge your savings

Don't kill the messenger, but some investment firms suggest having roughly three times your annual salary saved in a retirement account by 40. By age 50, that recommended factor jumps to five. This may feel like an outrageous sum to achieve, but it's fair to say that the onus of saving for retirement is squarely on the individual these days. With the extinction of pensions (for the most part) and uncertainty hanging around the fate of Social Security, it's never been more critical to save for our future.

If you have access to a workplace retirement account like a 401(k) and have reached age 50, know that you can play some catch-up by contributing an extra $6,500 this year. IRA savers ages 50 and older can invest an additional $1,000.

We are currently in a bear market, or a sustained period of downward price trends in the stock market. If you're approaching retirement -- or in the early stages of retirement -- and your portfolio has taken a severe beating in recent months, it may be worth reviewing your level of exposure to stocks with the help of a financial professional. If recent market volatility is causing you anxiety, it could mean that you have a smaller appetite for risk and need to reassess.

This may also be a good time to rethink your retirement age. If you had to work part-time or full-time throughout your 60s and into your 70s, what would be your ideal role? Some early strategic planning is never a bad thing.

3. Debt: Don't worry about paying off your mortgage

The idea of retiring without a mortgage sounds relieving, but in actuality, it may mean making extra payments every year to get there. Is it worth it? If you have many financial goals competing for your attention right now -- from saving for retirement to putting a child through college or supporting an aging parent -- then don't worry about paying down your mortgage right now.

If you closed on a mortgage prior to 2022, your fixed rate is probably very low, and it's probably not worth accelerating your mortgage payoff, especially with a recession looming. During an economic downturn, it's better to put that money in a savings account for when you'll need more cash on hand, or focus on the financial moves that will produce a higher rate of return such as investing.

4. Family finances: Crack the money talk with your parents

Though it may be awkward to talk about money with our parents, it can be beneficial for both parties. During tough economic times, parents can be a resource because they've experienced many economic cycles and can offer some perspective.

The other more important details can be... trickier. But it's important to discuss whether your parents have a will or a living trust, and whether they have named a power of attorney (someone who can step in to make financial decisions if they are unable to do so).

Cameron Huddleston, author of Mom and Dad, We Need to Talk, joined me on my podcast and discussed her mother's battle with Alzheimer's. Huddleston wished she'd discussed money with her mom before the diagnosis. "When I saw that she was having trouble with her memory, suddenly, it was no longer a what-if type of conversation. It was, 'Oh, my gosh. This is happening. What are we going to do?' This is why people need to have these conversations sooner rather than later … so that they can be talking about hypothetical situations. Not: 'We're in the thick of it now. It's an emergency. Emotions are running high. How do we deal with this?'"

A wise way to start the conversation, said Huddleston, is to use a personal story of someone you know who went through hard times because they didn't talk about money with a parent. At this stage in life, "You're bound to know someone who has already started dealing with issues."

5. Kids' college: You're not a bad parent if you can't afford it

Really, you're not. If your child is college-bound and you haven't saved for this expense, do what you can. But also remember that there's a great deal students can do on their own to alleviate the cost burden. Sacrificing your own retirement or pulling from emergency savings, while tempting, may come back to haunt you -- and your grown-up child -- if you have a hard time replenishing those funds down the road.

A critical part of college planning is discussing all the affordable pathways with your child -- and there are many, such as merit scholarships and grants, work-study programs, attending a local community college first, working part-time to afford the college credits or considering a career where student loan forgiveness is a potential option. And remember, college may not be the ideal path for everyone. Vocational school, coding bootcamps and apprenticeships are all valid alternatives these days.

Also, consider the following: Open a 529 college savings account where your money can compound and, depending on your state, you can receive a tax break. If your child is still a ways away from college and saving is proving difficult these days, don't sweat it.

Source

Blog Archive

-

▼

2023

(68)

-

▼

February

(19)

- YouTube Names The Top 10 Most-viewed Videos Upload...

- Are We In A Recession? Here's What You Should Know...

- Should You Buy Used Camera Gear?

- DJI's Compact, Folding OM 5 Stabilizing Gimbal For...

- Apple Watch 7 Review: A Slight Upgrade Compared To...

- Best Money Tips For Gen Xers In A Shaky Economy

- Xiaomi Redmi 2 Review: Value, But Not Without Cost

- Magic Leap 2 AR Headset Arrives Sept. 30, Starting...

- 2022 Kia Carnival Long-Term Update: Detroit To LA ...

- Hisense Chromebook Review: A Cheap Chromebook That...

- Thunderstorms Delay, Cancel Thousands Of US Flight...

- Tesla Faces More Lawsuits Alleging Sexual Harassme...

- Twitter Unveils Plan To Combat Misinformation In 2...

- Get This Lenovo Chromebook 3 For Just $79, A Disco...

- 10 Apps For Editing Photos Before You Post To Inst...

- Qualcomm's New W5 Chips Could Bring Better Battery...

- Google Pixel 6 And Pixel 6 Pro Models Drop To All-...

- Qualcomm's New Snapdragon 8cx Gen 3 Aims To Create...

- Apple's MacBook Pro Models With M1 Pro Chip Hit Ne...

-

▼

February

(19)